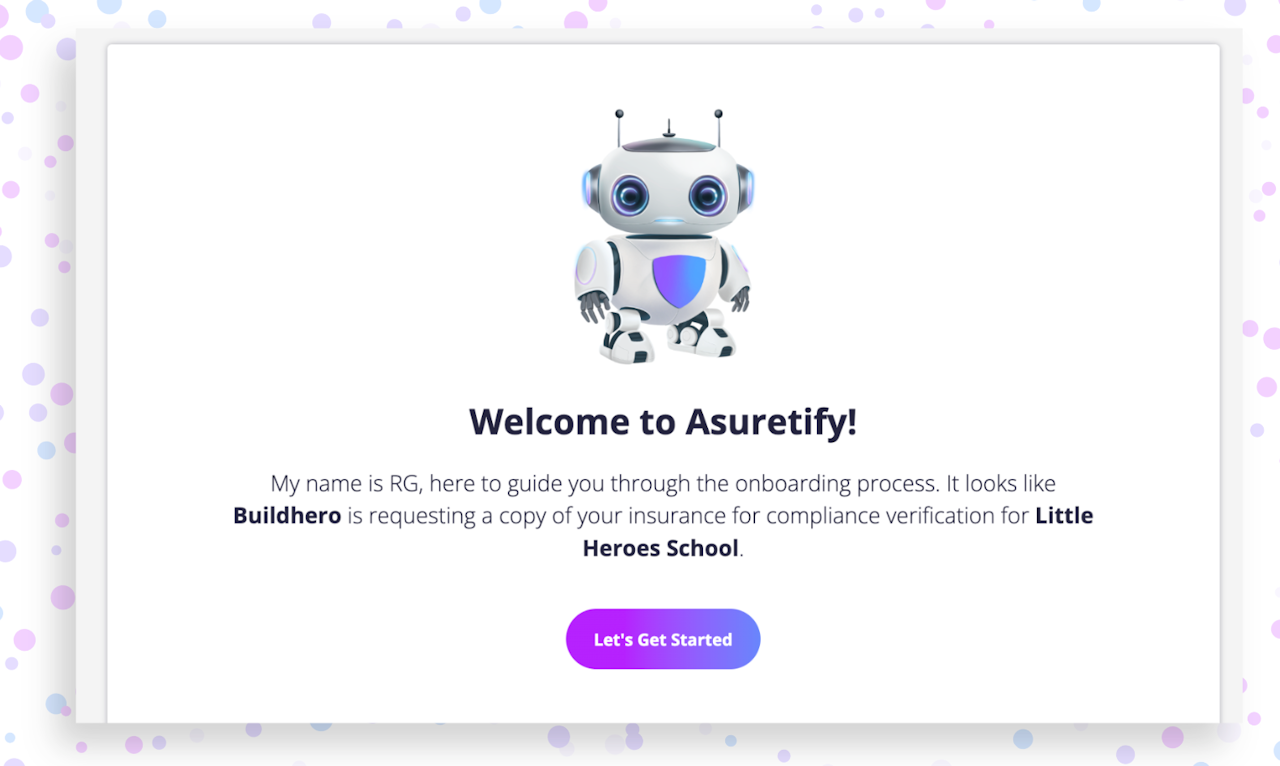

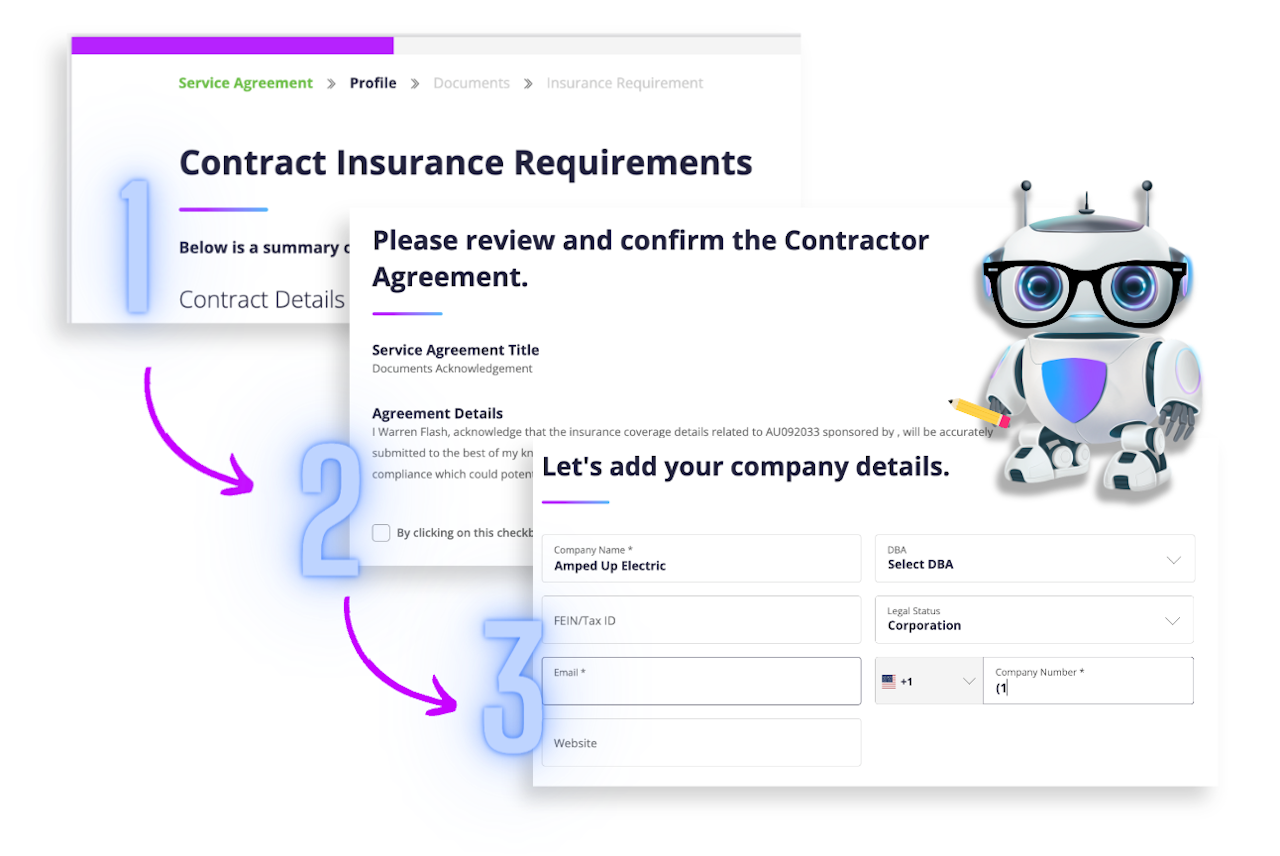

Preparing to Onboard

You have been invited to provide insurance coverage documents for verification purposes. After clicking to get started from your email invitation, you'll need to set up a password to secure your account before reviewing contract insurance requirements.

After reviewing the insurance requirements, you can choose to 'Assign to Another User', 'Ask my Agent', or 'Start Onboarding'.

Click 'Start Onboarding' to start verifying your details and upload insurance documents. If you choose 'Assign to another user' or 'Ask my Agent', you are inviting them to complete the onboarding process on your behalf.

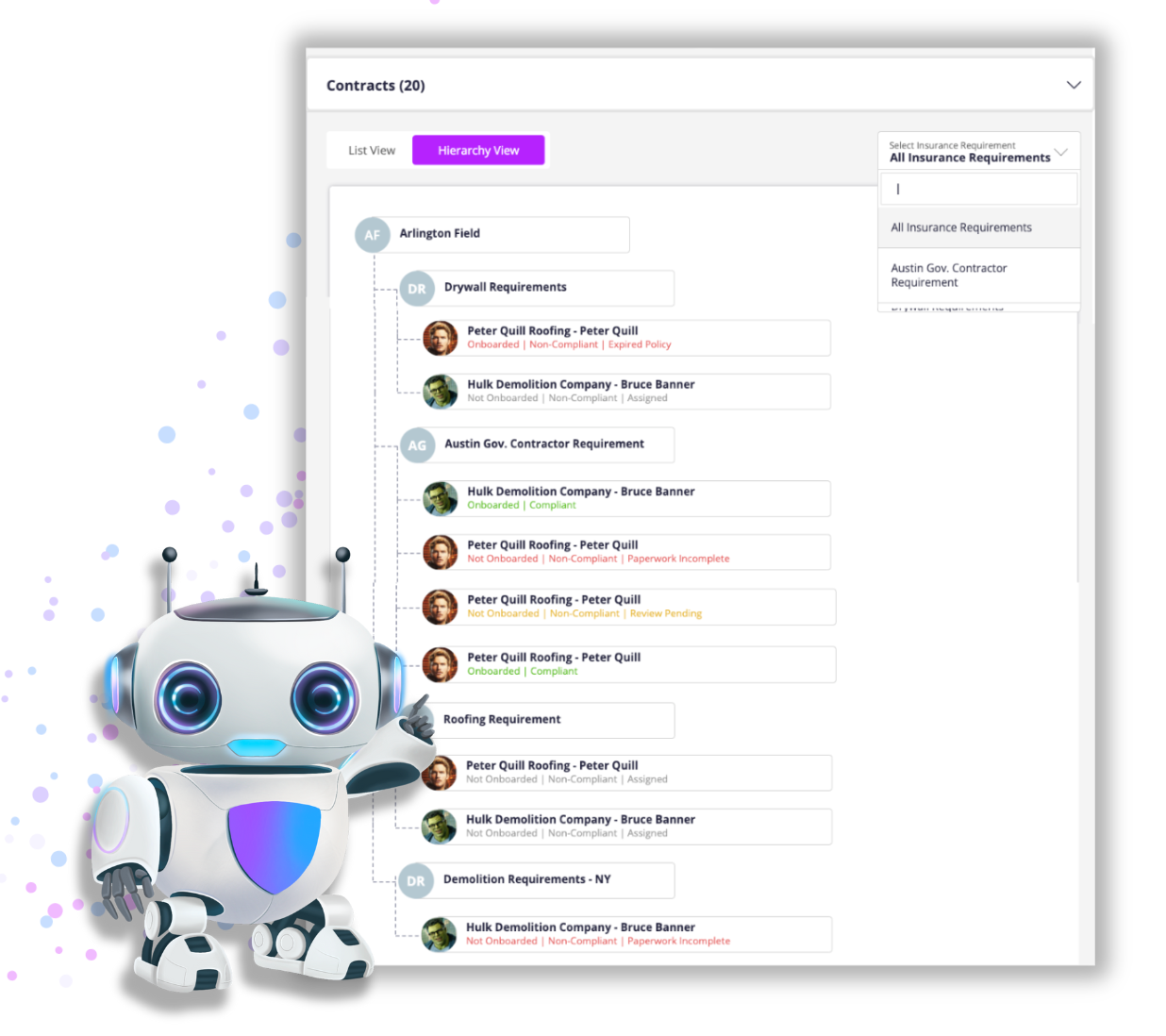

Contract Requirements are the minimum insurance coverage limits outlined and assigned by the requesting company or organization that the insured user must carry.

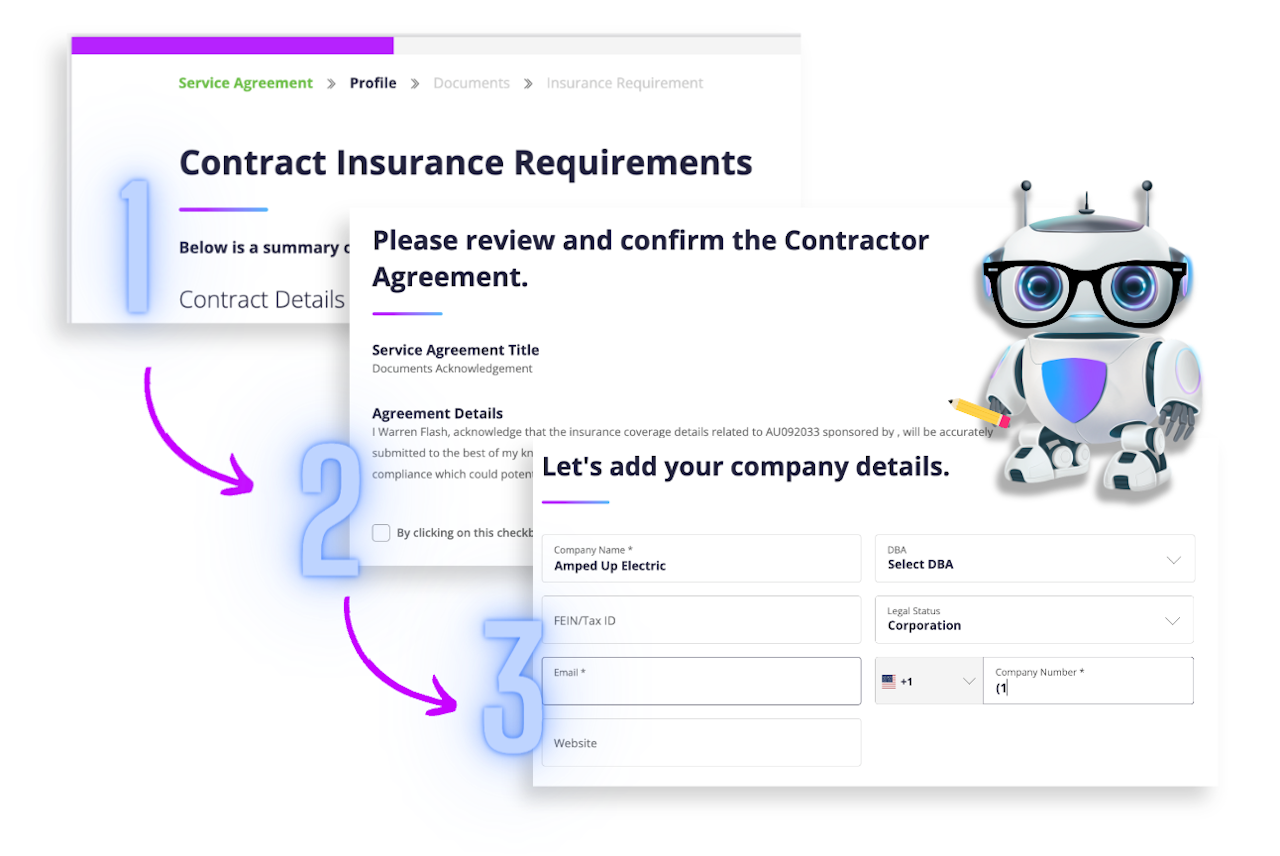

Review Requirements & Details

Reviewing the insurance requirements is an important step to ensuring speedy verification. These requirements are like your checklist for success! Here you'll find the lines of business, organized along with their minimum required limits. If endorsements or scheduled wording are required as part of the assigned contract, you will see those here as well.

When you have reviewed the requirements, continue by clicking “Start Onboarding”

Add & verify your company details. This will include filling in the mandatory fields: Company Name, Email, Company Phone Number as well as entering the optional fields: FEIN/Tax ID number, selecting DBA, Select Legal Status, and providing a company website.

Double check that everything looks correct, and now you're one step closer to becoming indisputably verified with Asuretify!

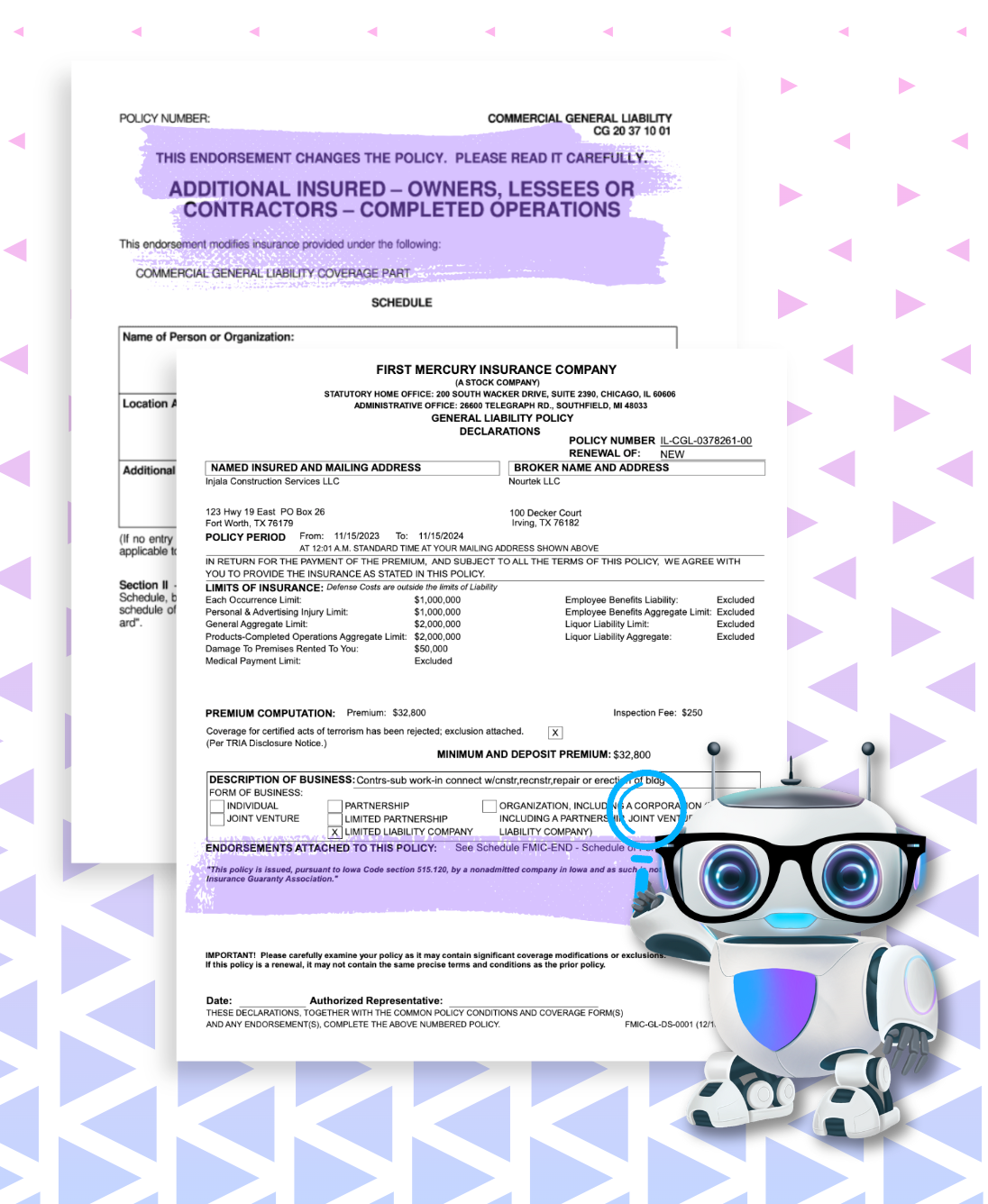

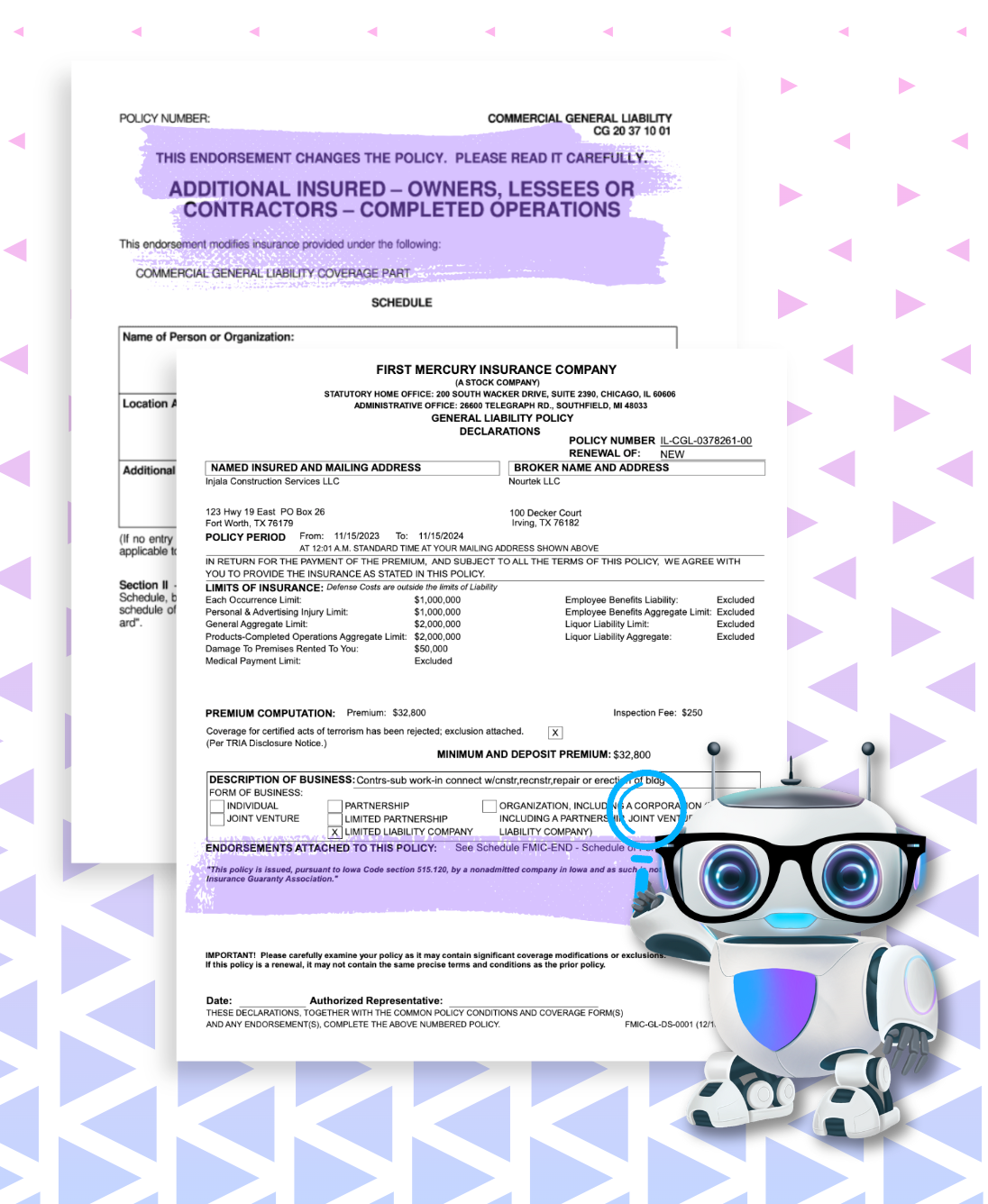

Understanding Policy Endorsements

If your assigned contract has endorsement requirements, an easy way to identify if you have one of the below endorsements is by the endorsement number, usually found in the header or footer of the policy. If that unique code matches one of the acceptable endorsement requirements, then you carry an acceptable endorsement required for the assigned contract.

Hold the celebration, you're not quite done yet. You may have scheduled wording requirements for the endorsement. This directs the endorsement legal language towards a person, organization, or even a location. This is common for requestors of coverage to require specific endorsement scheduled language.

No need to be an insurance expert, Asuretify’s Artificial Intelligence helps you decipher the endorsement requirement. If you don't have the correct endorsement, no worries! You can request this from your agent before submitting, ensuring your coverage meets the requirements. Now that's something to celebrate!

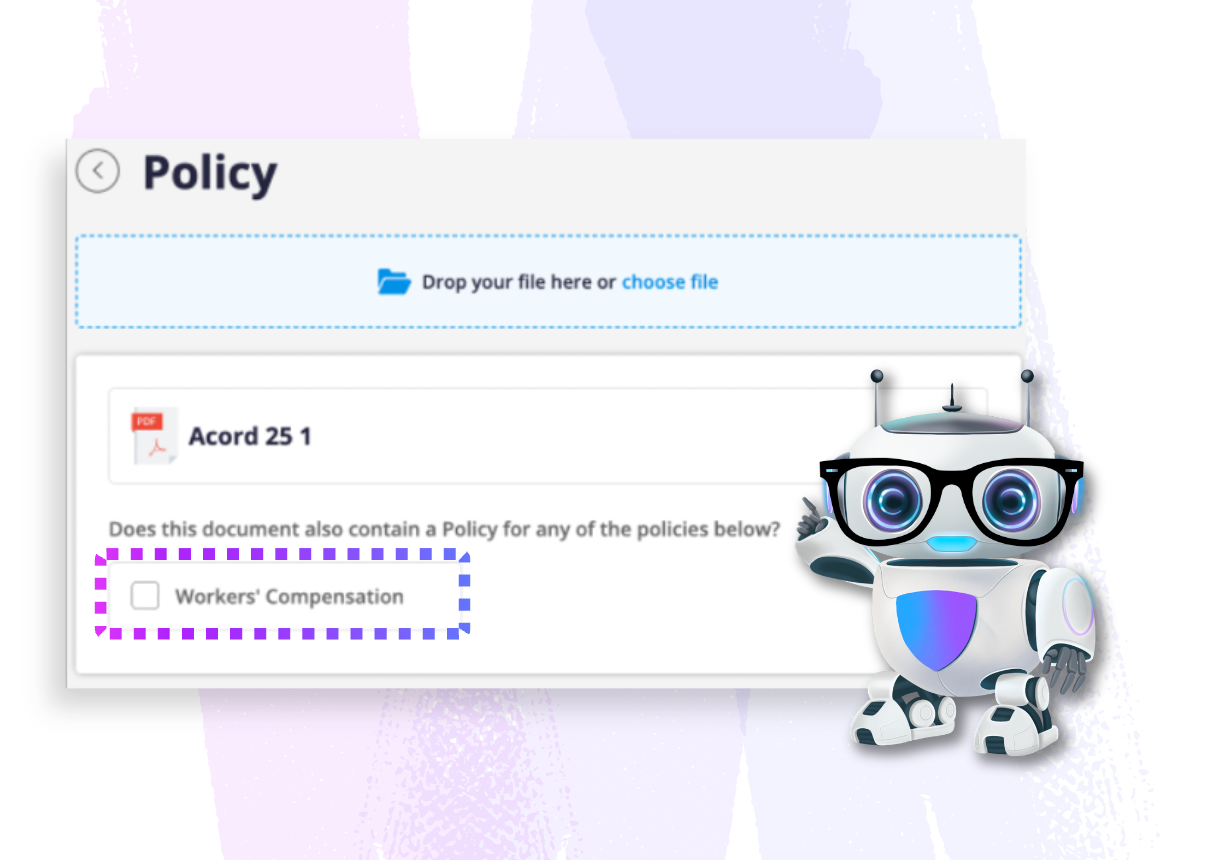

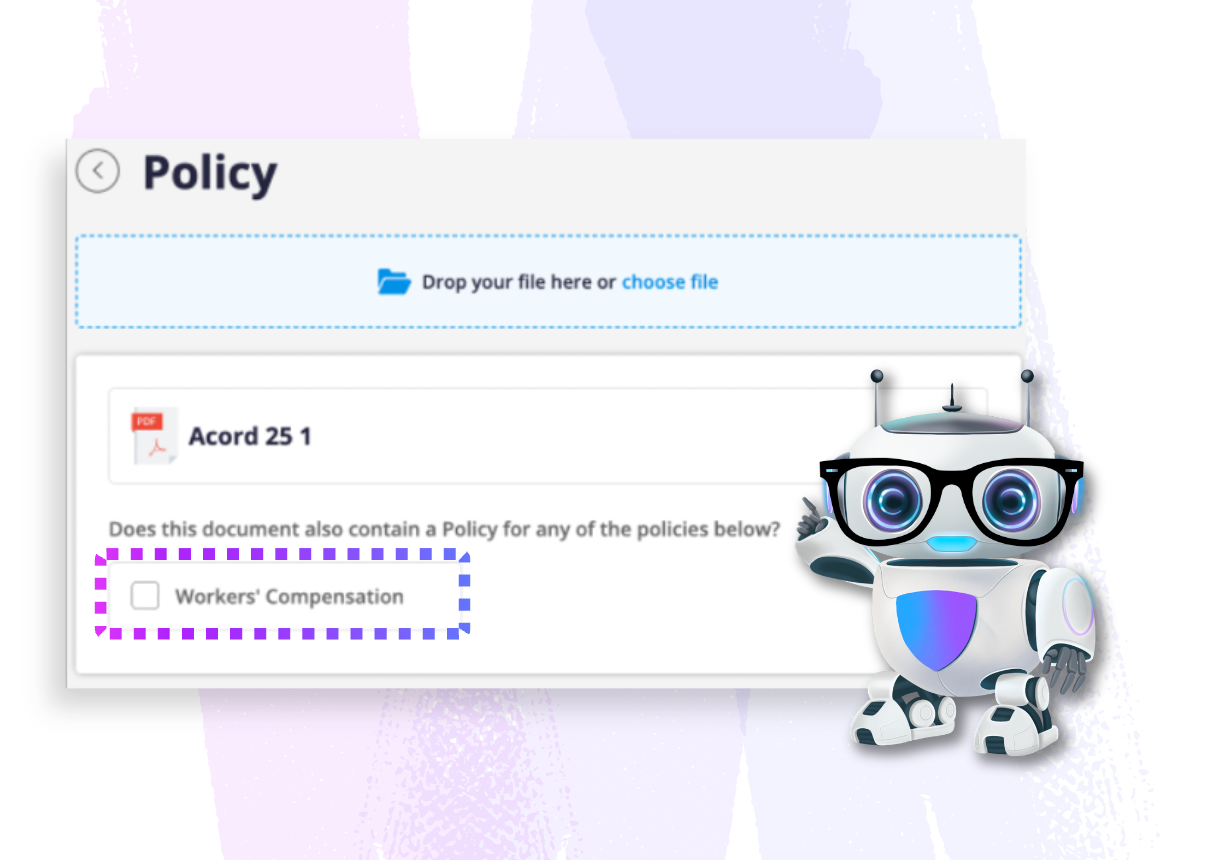

Uploading Documents

Uploading required coverage document(s) is an important step in the compliance verification journey. You can either drag and drop the files into the system or select “choose file” to select your document from your folder. If the contract requires multiple lines of business, you will be able to select areas the document includes coverage for.

Next up is adding your agent details!

Downstream Risk?

Do you have any subcontractor(s) working for you? If you see this question, the project owner, site owner, or general contractor may be required to track the insurance of any subcontractor or sub vendor/tenant that ison-site to provide work or services.

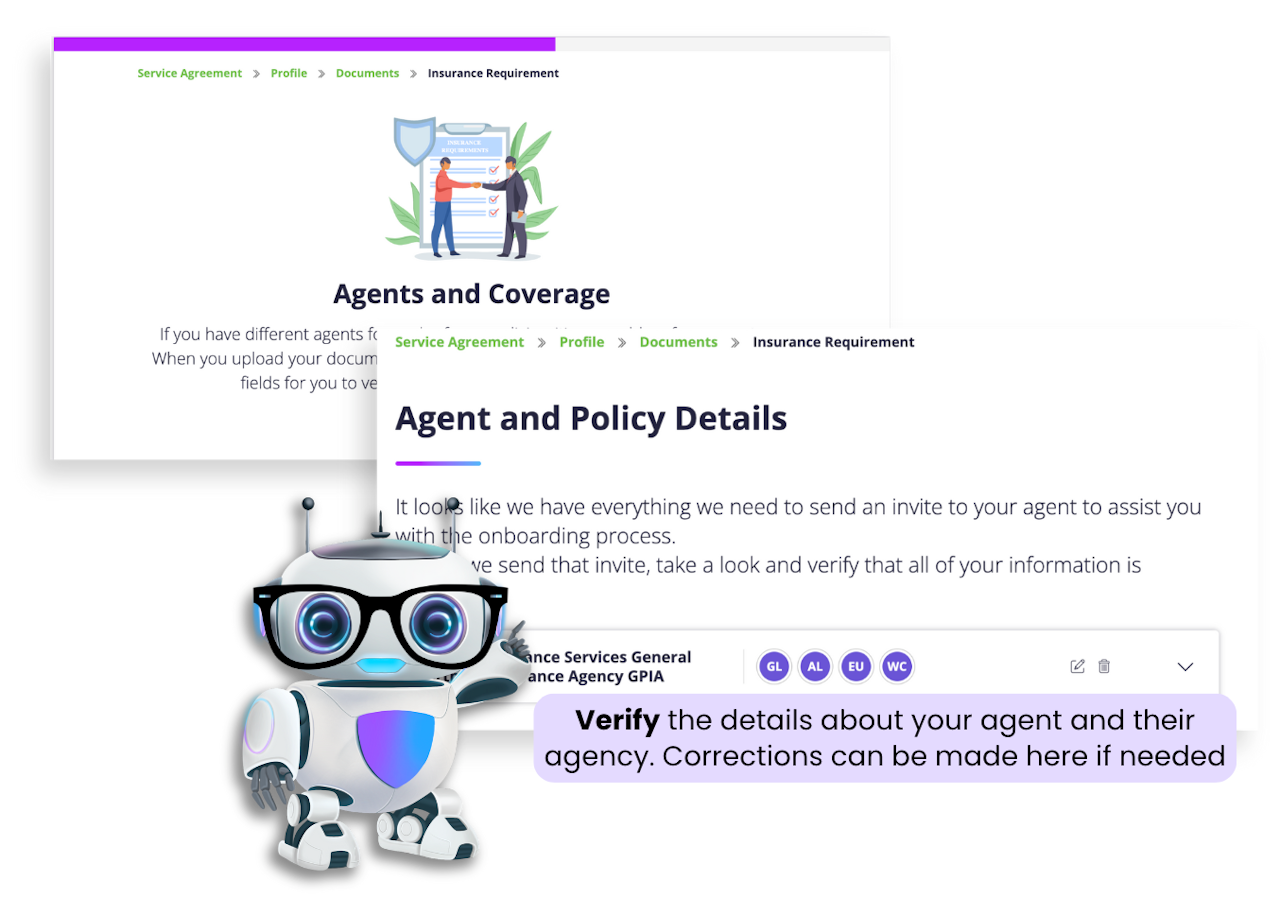

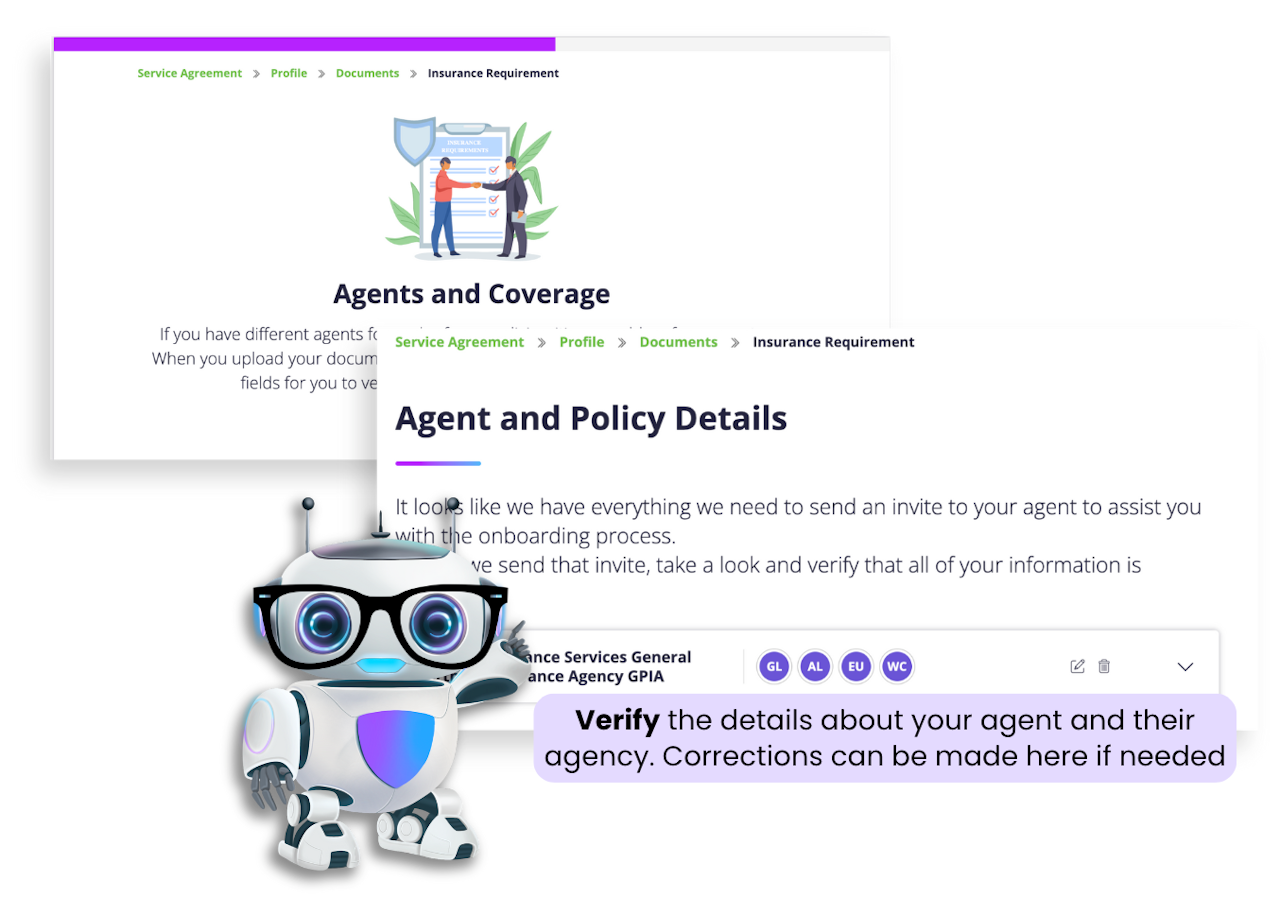

Adding Agent & Details

Verifying your agent(s) is an important step to ensuring our artificial intelligence has properly gathered your details.

Asuretify's AI is able to read several document types, identifying key details such as your agent, their contact details, and limits related to your coverage. These read details are gathered to pre-fill fields for verification.

If your agent has never been added to the Asuretify system, you will need to enter their email. After, you will assign the policy to the agent.

Adding Additional Comments

Adding additional comments or instructions for the administrator is the last screen before you review and submit your details for verification.

We understand that insurance can be complicated sometimes and want you to achieve that compliant status ASAP. The comments section has been added to allow you to leave a note or instructions for the reviewer/administrator.

Notes you may need to include are:

Informing the administrator that one of your policies is not compliant

You are exempt from a type of coverage

Any other discrepancy impacting your compliance status

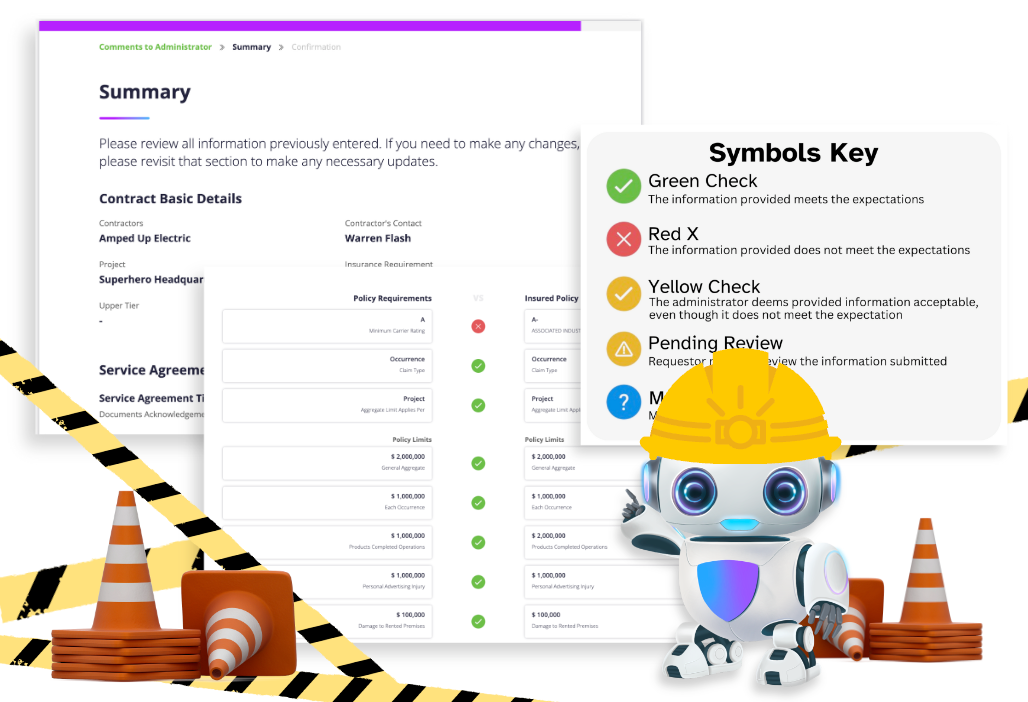

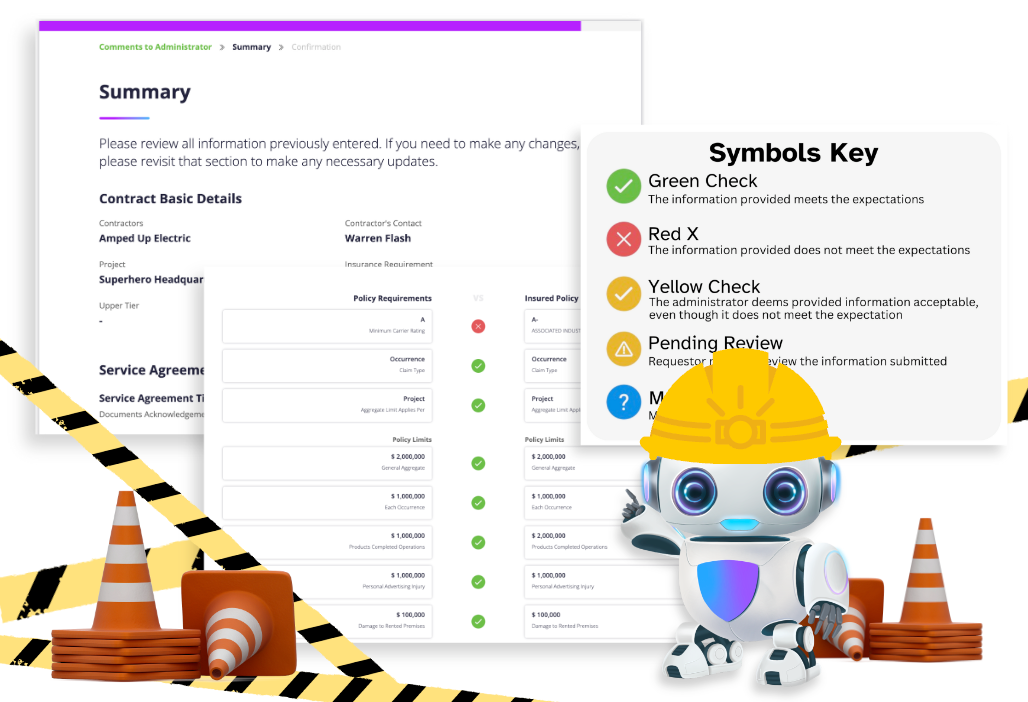

Comparison Summary

The Summary Screen shows you a comparison of your coverage with the requirements set by the requestor.

A Green Check indicates that the provided coverage information meets requirements that have been set by the requestor

A Red X indicates that the provided coverage information does NOT meet the requirements that have been set by the requestor

If any of your details show a Red X, you can include a note to the administrator to see as they review your details. The requestor can choose to mark your coverage as 'Conditionally Compliant' and communicate with you further regarding coverage details.

Submit for Verification

The last step is to click 'Submit' to send your documents to the requestor for review. When you do this, the requestor will be notified.

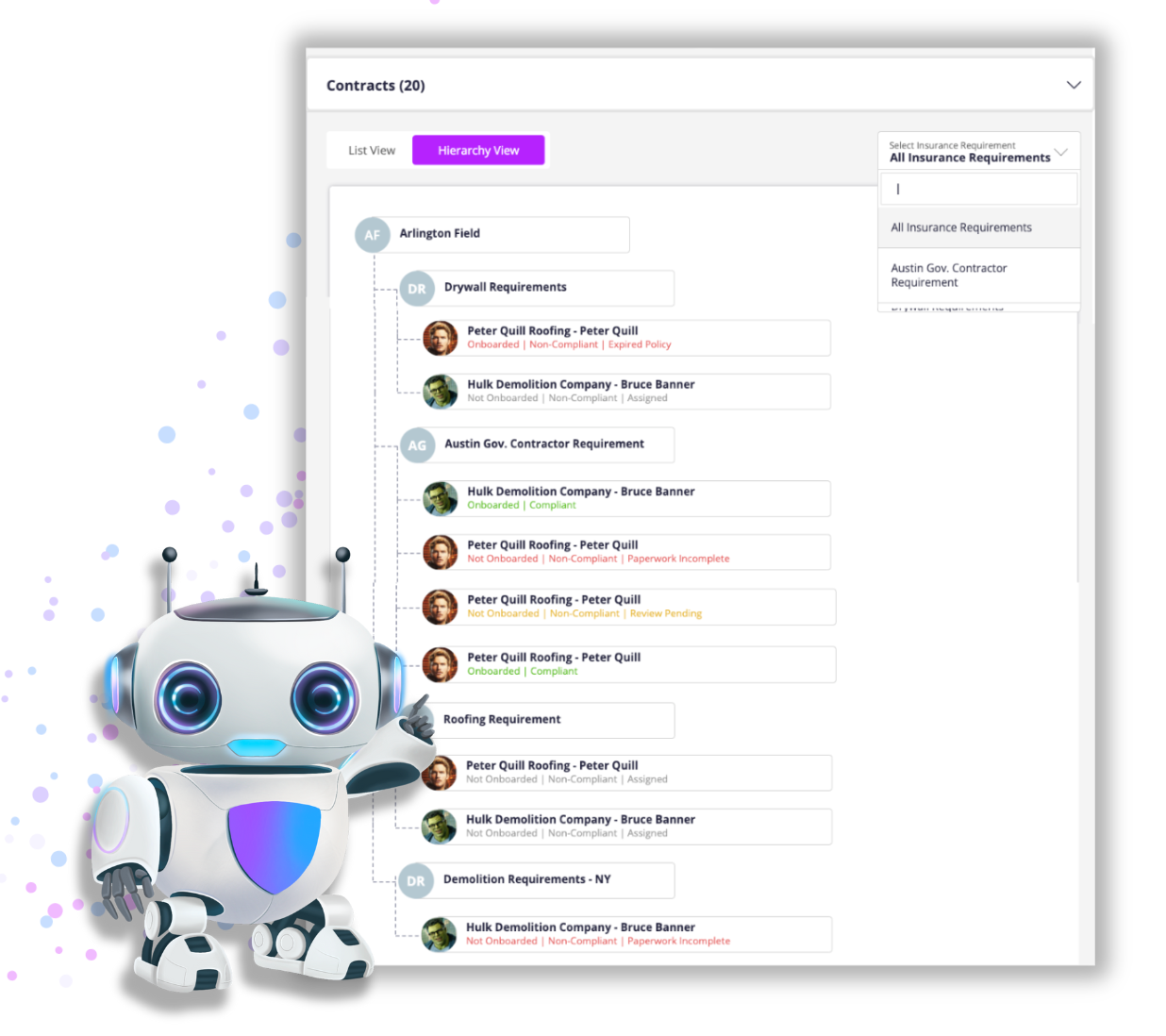

How do I know my compliance status?

Right now the status will appear as "Pending Review" until the administrator confirms your compliance. Once the requestor reviews your documents and marked your compliance status, you will be notified by email. You can generate a compliance letter which includes a unique QR code which can be scanned to show your compliance status.

Coverage marked as non-compliant will be returned with feedback on revisions required. If you are non-compliant and need to update coverage details, follow the email link to navigate back to the contract to provide the updated details for your compliance. The updated details will need to be reviewed before you coverage can be marked as compliant and onboarded.

Just like that, your hard work is done... for now! Using Asuretify saves you time with the compliance verification process.

What will you do with all that added free time?